That was my reaction to this latest bit of Government bastardy:

The Biden administration has made clear its plan to beef up IRS auditing by expanding the agency’s funding and power. Biden’s latest proposal would require banks to turn over to the Internal Revenue Service bank account information for all accounts holding more than $600.

…

“There’s a 99 percent compliance rate on wages – because wage earners get their earnings reported to the IRS,” a fact sheet says that was handed out by the White House to lawmakers to sell them on the plan. “But the super wealthy who get their income from unreported sources are able to hide their income and avoid paying the tax they owe. In fact, each year the top 1 percent chooses not to pay more than $160 billion in taxes.”

Just out of curiosity: if the “super wealthy” are not paying those taxes, how is the IRS able to put an actual number on that “uncollected” amount? Or is it just an estimated, i.e. invented number?

I note that there’s been some pushback:

“While the stated goal of this vast data collection is to uncover tax dodging by the wealthy, this proposal is not remotely targeted to that purpose or that population,” the letter said. “In addition to the significant privacy concerns, it would create tremendous liability for all affected parties by requiring the collection of financial information for nearly every American without proper explanation of how the IRS will store, protect, and use this enormous trove of personal financial information. We believe that this program is costly for all parties, not fit for purpose, and loaded with potential for unintended and serious negative consequences.”

That’s telling them. And it will be roundly ignored, as usual.

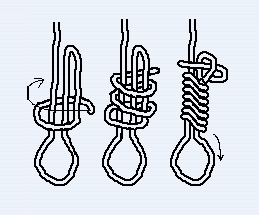

I don’t even want to talk about the intrusiveness of this motherfucking proposal because it just makes me want to sharpen my bayonet and oil the rope. As it is, my bayonet is sharp enough and if I oil the rope any more, it’ll be too difficult to tie the knot.

(for information purposes only)

At what point do we say, “Enough is enough?”

Asking for a friend. And for informational purposes only, check out the sale items here, if you aren’t already thus equipped.

Interesting that they think that someone with $600 in their account is ‘super-wealthy’.

They don’t. They just want access to your information so they can control you.

Everything within the State. Nothing outside the State. Nothing against the State.

As you point out, the cure isn’t connected to the disease. So what is it for. My guess is that it is cover for those 80,000 new IRS agents who will be a new cadre of shock troops that can be deployed for any purpose.

Something in my failing memory says that the traditional hang man’s knot should contain thirteen loops. Of course the seven loop version as illustrated can be used in the interest of time or in the event of a rope shortage.

Historical descriptions of poorly done hangings tell of decapitation if the drop was too long or the guest of honor was particularly obese.I see that as a feature, not a bug and would probably pay the hangman a little extra.

As would I.

That’s why you use the table of drops. The British hangmen were professionals, they had it all worked out.

The zman did a podcast last Friday, diving into the Declaration of Independence.

Basically, everything and every reason we went to the war with the Brits is happening today.

https://thezman.com/wordpress/?p=25229

There is a fundamental difference between wealth and income which this article ignores and conflates. You can have a large income and negative wealth (spending more than they make ) — Jonnie Depp, Hunter Biden and Nick Cage come to mind. Conversely, Warren Buffet and Elon Musk have great Wealth but relatively small incomes to cover modest actual expenses. ( everything gets immediately invested to grow their respective enterprises which never shows as “income”).

The wealthy have the resources available to structure their finances in a manner that minimizes the amount taxes they pay. ( and there’s nothing wrong with that) By the time Congress gets around to changing the rules, the wealthy have readjusted to minimize the impact.

And the Wealthy don’t ” each year the top 1 percent chooses not to pay more than $160 billion in taxes”. They follow the rules — but they choose to use those rules in ways that were not anticipated by the people who created them.

…. and who would “choose” to pay more in Taxes

Is there any guess as to whether Congressmen, Senators, WH Staff will be exempted from this requirement.

Trojan horse stated goals aside. Its nothing more than an attempt to allow the .gov to view even minute transactions of people, preventing them from opting out of the “System” (e.g. cash transactions, maybe barter). Because its under the umbrella of “Taxation” it will survive legal challenges.

A few things that come to mind about this:

Just who is the 1% that’s avoiding the $160 Billion in taxes? Could it be Techno Billionaires and Hollywood elites? When a certain Bazillionaire can drop $6billion in one day because some Deep Throat wannabe spends a couple hours before a Washington committee, how much of a write-off do you get for that?

And aren’t these the same people that donate heavily to the Democrats who suddenly want to raise taxes? If I’m one of those donors, (and I’m not,) the size of my political donations will drop as my tax hit increases.

And just who might some of those tax scofflaws be? I can name some: President * and his wife, DOCTOR Jill *, First Son, Hunter *, and mail-order self-appointed Reverend Al Racebaiter.

And as for the $600 IRS reporting threshold, I don’t know about anyone else, but I figure I’m Joe Average, with Social Security and pension deposits over the target line, and a monthly mortgage payment also over the proposed limit. Right there are three times a month my name will be reported to some government database beyond wherever it is already.

I’d just as soon pass, thank you. I don’t need the added attention.

As Judge Learned hand wrote:

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.

Only preussenotto mentioned the key word : “cash”.

Its revival is on hand and there will be many new forms of it.

In ten years you will prefer a note of hand from someone like Michael Miebach, CEO of MasterCard over that of any US Secretary of the Treasury, currently the grossly incompetent and dishonest Janet Yellen.

RE: “oil the rope” KDT

Boil rope or oil rope?

Both are done to Manila and sisal ropes. Which do you do before stretching a neck?

Dan Kurt

Stretch the rope first.

Supposed ancient Chinese curse: “May you come to the attention of the authorities.”

The Chinese would know.

The man spent 49 years in the Senate establishing tax laws full of loopholes for him and his cronies. If Amazon, Windows, Berkshire Hathaway etc. etc. etc. were expecting to not have those same or more loopholes, do you think their CEOs would have spent so much money getting him elected? Big liberal companies that fund PACs that support Dems will still carve outs. Joe the plumber with 30 guys in trucks that donates to Conservatives will feel the squeeze.