Last week I received in my email something from these guys:

…with the following message:

Walmart, a company who’s known to be one of the biggest supporters of conservative causes, has just bowed to evil liberal demands. Here’s what happened…

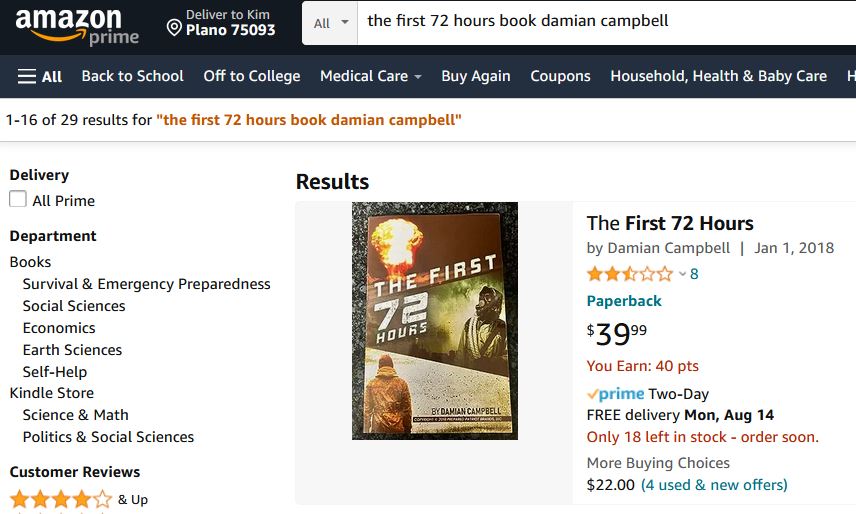

Several major companies (including Amazon, Walmart, Barnes & Noble and more) have decided it’s against Americans’ best interests to carry a new book on their store shelves. And the reason why should have you fuming…

The book is called The First 72 Hours.

The First 72 Hours was written by one of the world’s leading survival authors, Damian Campbell.

And the reason these companies won’t allow you to buy his book is because it exposes how the left is using the current political unrest to steal our freedom in ways we never imagined…

And it teaches you how to prepare for the coming collapse.

The secrets in this book are well-known by government insiders…

And Campbell has put them all in this book in an attempt to warn you about what is going to happen in the next few months.

Since Campbell isn’t allowed to sell this book in stores we convinced him to let us hand out a few copies at a deep discount.

Right now we have permission to give 50% OFF copies to the next 288 people who click here.

However, once you get access to this book you’ll need to review it ASAP.

I can’t tell you when the S will hit the F. But I can tell you Jesus was right that no man knows the hour – and that we should be vigilant and prepared.

Get your copy of The First 72 Hours for 50% OFF before they’re gone… and before it’s too late.

Being of a suspicious nature when people send me stuff and want me to spend money with them, I did a little investigation for myself. I didn’t look at Walmart, because the next time I buy a book at Wally World will be the first time, and the last time I bought anything at B&N was when we were still homeschooling the kids.

So onto Teh Intarwebz I went. A whole two minutes later, I came across this:

…so the second paragraph contained at least one lie, which kind of pissed me off right there.

But my ire having been aroused, I decided to do a little more digging, and found the following:

- the book is under 100 pages long — and for $40, I want something a little more substantial than what is basically a bullet-point list.

- it’s apparently published by “Prepared Patriots”, which printing house doesn’t exist.

- However, there is a website called PreparedPatriot.com, which sells the usual tactical / survival stuff. Are they the “publishers” of said book? Well, no — at least, I found no mention of the book anywhere on the website.

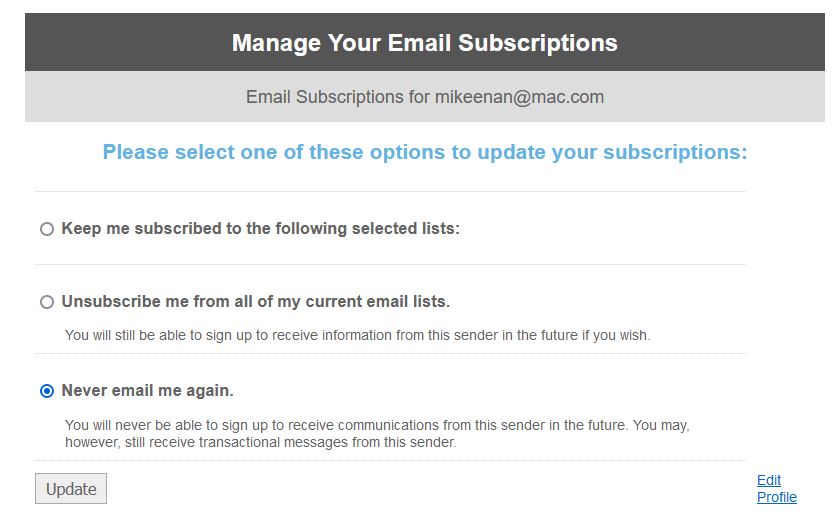

Well, what about this “Firearm Man” guy (or org)? Searching for “firearm-man.com” takes one here:

- “firearm-man.com” is just a fucking newsletter; basically, a means whereby people can send out spam to whoever.

So:

Fuck them, fuck their newsletter, and by the way, fuck Damian Campbell and his poxy little expensive brochure. I wouldn’t accept it as a gift, now.

Caveat emptor, y’all.