Following on from yesterday’s post on VW, Mercedes and Stellantis (the bastards), there’s this:

Car makers slash EV prices, suspend production and extend petrol model availability as electric demand wanes

The global downturn in sales of EVs has been triggered by a cocktail of diverging policies on green incentives, range and charge anxiety among drivers and the fact prices haven’t come down as much as experts had forecast.

As such, 2024 has been awash with a wave of U-turns by legacy car firms in response to a lower-than-expected appetite for electric vehicles.

‘Appetite for EVs among consumers is quickly diminishing. There are many factors contributing to this, including the lack of clarity around incentives, high prices and concerns around the low residual value of EVs.’

Yeah, not to mention the paucity of charging points when your Duracell phuts out, the cost of replacing said Duracell when it becomes as worn out as Madonna’s box at a P Diddy White Party, and those pesky spontaneous combustion episodes — to name but some “consumer concerns”.

Looks like corporate obeisance to the great Global Cooling Climate Warming Change© is losing its luster, especially when that pesky cold hard cash is involved. (Also see: Germany restarting coal-fired electricity generating plants.)

This is especially rich:

‘The new pricing structure on Corsa Electric and Astra Electric is the latest in a number of measures we have taken to democratise access to electric vehicles.’\

“Democratize access”, my aching African-American white ass. That’s just a fancy term for “getting rid of unwanted stock”.

But when it comes to weaselly corporate-speak, it’s hard to top this:

Volvo Cars chief executive Jim Rowan said: ‘We are resolute in our belief that our future is electric. An electric car provides a superior driving experience [nazzo fast, Guido] and increases possibilities for using advanced technologies that improve the overall customer experience [like having their every move tracked and sent to insurance companies and ad agencies].

‘However, it is clear that the transition to electrification will not be linear [ya think?], and customers and markets are moving at different speeds of adoption [or not moving at all, see above].

‘We are pragmatic and flexible [except of course when we try to coerce people into buying our Duracell cars by eliminating the ICE option completely], while retaining an industry-leading position on electrification and sustainability.’ [and I hope you’re the first to go out of business, Mr. Leader]

Wait… what’s this I’m experiencing?

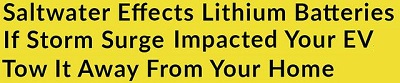

Oh, and one more thing, speaking of Duracell cars:

…not that any of my Readers would be affected, of course, being Sensible Chaps.

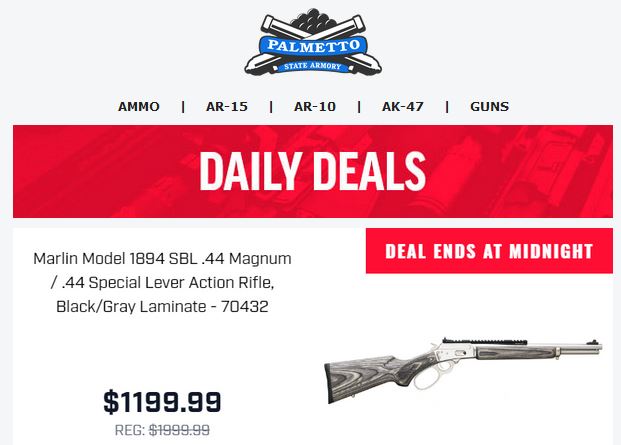

…and thanks for nothing, assholes.

…and thanks for nothing, assholes.