Reader JC_In_PA sends me an article about electricity, suggesting that it’s worthy of a 10,000-word rant. An excerpt:

In our modern age, the electric grid is the mother of all networks. Without electricity, advanced forms of transportation and communications virtually grind to a halt and nearly all digital and electronic devices are rendered practically useless. When the grid goes down, we lose conveniences like air conditioning, lighting, and other amenities that we often take for granted.

Several days ago, Spain, Portugal, and parts of France and Belgium lost power for an extended period of time, demonstrating just how devastating a total grid collapse can be to our modern way of life.

During this colossal blackout, the largest that Europe has ever experienced, more than 50 million people were left without electricity. Traffic signals did not work, creating utter chaos on the roadways. Subway systems couldn’t function, leaving people stranded far from home. Stores and businesses closed, as payments were limited to cash only. Mobile phone service was spotty, at best. Even some hospitals and medical facilities, which generally have backup generators, were left without power.

As of now, it seems that the sudden, system-wide grid collapse was caused by a malfunction at two solar power plants in southwest Spain.

And further down the page:

Now, you may be thinking that enormous, system-wide blackouts could never occur in the United States, the most prosperous nation in human history. That is not only naïve, but dangerous.

As the American Energy Alliance notes, “power outages have increased by 93 percent across the United States over the last 5 years — a time when solar and wind power have increased by 60 percent. Texas, who leads the nation in wind generation, and California, who leads the nation in solar generation, have had the largest number of power outages in the nation over those 5 years.”

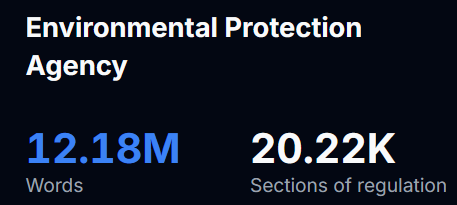

Unbeknownst to many Americans, the federal government, in cahoots with state and local governments, has pushed electricity grid operators to build more solar and wind power facilities instead of dependable natural gas plants while prematurely shuttering perfectly operable coal power plants. As is almost always the case, government subsidies, loan guarantees, and tax breaks have created a skewed market in which utility companies are incentivized to build more solar and wind power plants instead of dependable and affordable coal, natural gas, and nuclear power plants.

Due to this short-sighted money grab, the long-term reliability of the U.S. grid is being put in peril.

Well, I’d add my two cents to this little diatribe, but Loyal Readers will recall that I have spoken about this issue several times, to wit: February 2021, June 2021, January 2023, November 2023, and January 2024. (I have no idea what happened to 2022 — a mild winter, maybe — but there it is.)

Adding all that up comes to somewhat less than 10,000 words, to be sure, but I’m pretty sure that collectively, the “rant” part has been well addressed, e.g.:

We need to stop being fearful about our energy needs, toot sweet, and if the existing electricity providers are being hampered, the reasons for said hampering need to be eliminated before we start having Third World problems of rolling blackouts and “load shedding”.

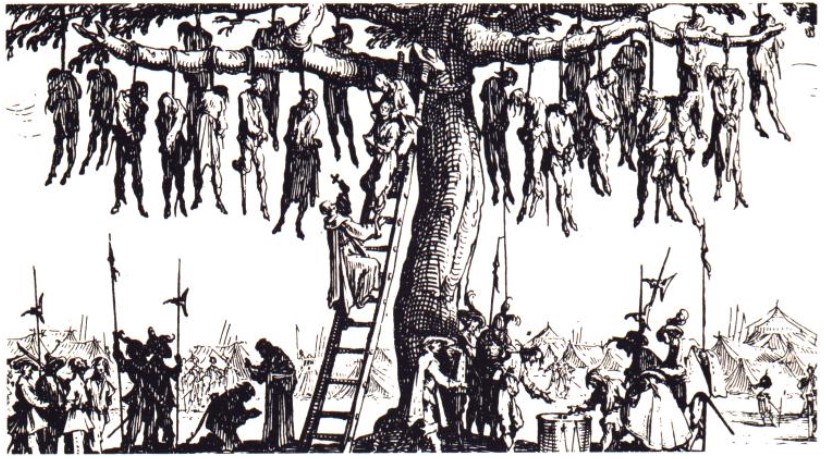

And by “eliminating” I mean this:

Anyway, my interest in such surveillance by the .gov is minimal, although I am a kindred spirit of Tom Knighton’s in that:

Anyway, my interest in such surveillance by the .gov is minimal, although I am a kindred spirit of Tom Knighton’s in that: