When it comes to hatred of corporations, I yield to no man thereof. Having worked in the festering cesspits of same on more than a couple of occasions, I know how they operate, and the depths of corporate bastardy in which they have no problems swimming.

This is especially loathsome when it comes to rolling over and offering up the corporate belly for the godless government agencies to scratch (and even claw, sometimes).

Small businesses, by comparison, have shown a great deal more spine than their larger brethren. One has only to recall that gym owner in New Jersey who, when overcoming the totalitarian state government agents and the governor during the Great Covidiocy, ended up giving all of them the finger when the eighty (80!) charges against them were all dismissed with prejudice.

Back when I was running a supermarket chain’s loyalty program, I always made it clear that individuals’ right to privacy was paramount when it came to their shopping data and habits. On more than one occasion I told divorce lawyers to piss off when they came snooping around, a couple of times facing them down when they threatened me with a subpoena. (When I shared one of these incidents with the guys who were in my share group, one owner of a small chain said, “Oooh, I wish that some asshole would come after me with a subpoena; I’d go to jail with the greatest of pleasure, and the positive PR I’d get for the company would be worth millions!” He was seventy-five years old at the time.)

Of course, the banking industry — to a man, it seems — shows no such defiance when the feds come a-calling:

A new report released by the House Judiciary Committee, in partnership with the Select Subcommittee on the Weaponization of the Federal Government, reveals extensive violations and abuse of the law by the federal government.

According to congressional investigators, the FBI abused the Bank Secrecy Act in order to work with banks to target opponents of the Biden administration and Trump supporters.

“The information obtained during the Committee and Select Subcommittee’s investigation, and detailed in this report, is concerning. Documents show that federal law enforcement increasingly works hand-in-glove with financial institutions, obtaining virtually unchecked access to private financial data and testing out new methods and new technology to continue the financial surveillance of American citizens.

“Documents obtained by the Committee and Select Subcommittee demonstrate that federal law enforcement increasingly relies on financial institutions for highly sensitive information about Americans without legal process. Federal law enforcement has effectively deputized financial institutions to advance its investigations and to gain access to the information that financial institutions possess. As financial institutions’ capacity to track and gather data on Americans continues to increase, federal law enforcement will continue to be incentivized to rely on banks for easy access to sensitive information about Americans’ private lives.”

Now I can — sorta — see the point if the purpose is to track down gangster money-launderers or tax evaders (and even then, I’m skeptical in the extreme because nunya). But that wasn’t the case here:

In a previous investigation done by the Committees, investigators found the FBI was flagging purchases that included “MAGA,” “patriot” and even bibles. As Townhall reported in January 2024:

Federal law enforcement agencies partnered with a number of financial institutions to flag transactions with the terms “MAGA,” “Trump” and more. They also monitored transactions at stores like Cabela’s and Bass Pro Shop. Other purchases linked to religious texts, like Christian bibles, were flagged under the guise of “preventing extremism.”

Further, the FBI has conducted hundreds of thousands of illegal searches without proper warrants in recent years.

I realize that Trump’s DOJ is going to have its hands full for the first couple years of the new Administration. But I hope they can spare a few moments to track down the bastards who authorized this nonsense, prosecute and imprison them.

Then again, as it was the FBI themselves who indulged in this un-Constitutional larceny, I’m not holding out much hope.

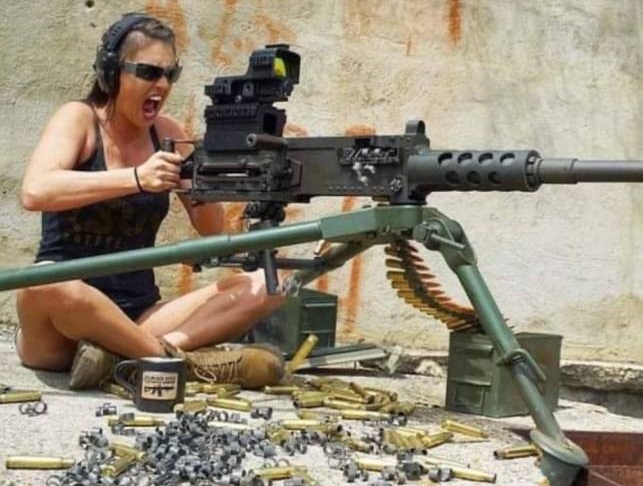

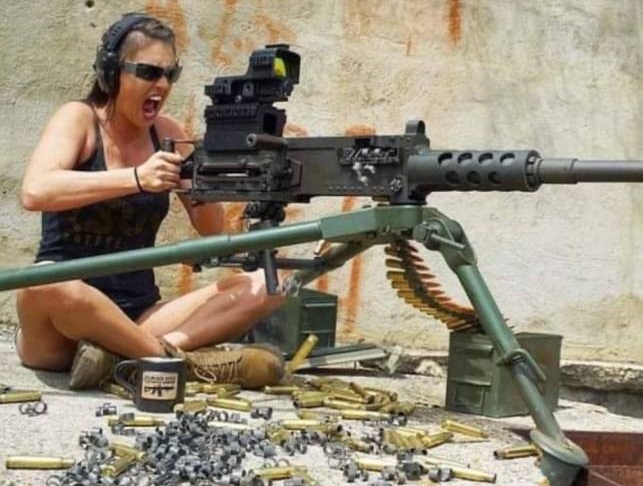

And they wonder why pics like these are so popular…